As an e-commerce business owner, you are always at risk for various forms of fraud. Whether it’s a customer trying to return a fake item, or an employee stealing from the company, fraud can come in many forms. That’s why it’s important to be able to identify and combat fraud when running an e-commerce business. Keep reading to learn how to do just that.

Implement secure payment processing procedures.

Online businesses can take a few key steps to help minimize the risk of fraud and protect their customers’ payment information by implementing secure payment processing procedures. This means using a reputable payment processor that encrypts customer data and follows security best practices. It’s also important to keep your software up-to-date, as new vulnerabilities are constantly discovered. You should also be suspicious of emails or personal information requests that seem too good to be true. And finally, always encourage your customers to use strong passwords and enable two-factor authentication when possible.

Understand ATM fraud.

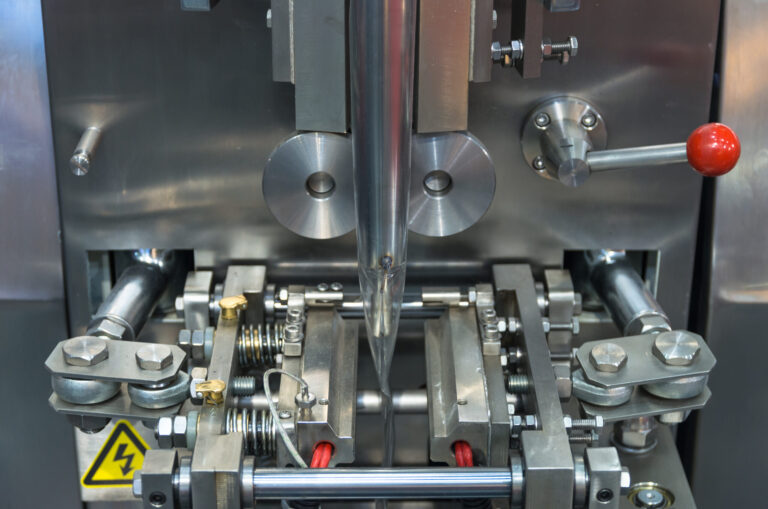

ATM fraud is the use of stolen, counterfeit, or illegally obtained debit or credit cards to withdraw cash from ATMs. Thieves often use sophisticated methods to steal card information or create counterfeit cards. If your business has an ATM to accelerate cash-only purchases, you may be at risk for bank ATM fraud. ATM fraud can be carried out in a number of ways, including skimming, card trapping, and malicious software. Skimming is a method of stealing card information by copying the data from the magnetic strip on the card. Thieves attach a skimming device to an ATM or point-of-sale terminal, and the device copies the information from the card as it is swiped.

Card trapping is a method of stealing cards by trapping them in the ATM card reader. Thieves attach a device to the ATM that prevents the card from being released until the thief enters a code or PIN. Once the card is trapped, the thief can withdraw cash or copy the card’s information. Additionally, malicious software, or malware, is a virus installed on a computer or ATM to steal information from the card’s magnetic strip. Thieves may install malware on an ATM by attaching a USB drive or hacking into the computer system that controls the ATM. The consequences of ATM fraud can include lost money, stolen identities, and damage to credit ratings. Banks may also charge customers for fraudulent transactions; some may even refuse to refund customers for lost or stolen money. This could lead to disgruntled customers and a diminished reputation, so it’s best to check your ATM regularly for potential fraud.

Verify customer information before authorizing transactions.

When verifying customer information, you want to make sure that the person is who they say they are and that they have the authority to make the purchase. One way to verify customer information is by looking at their driver’s license or another form of identification. You can also ask them for their name, address, phone number, and email address. Another way to verify customer information is by checking their credit card. You can do this by looking at the credit card number, expiration date, and security code on the back of the card. You can also call the credit card company to verify that the credit card is valid.

Stay vigilant about your vulnerabilities.

Running a successful e-commerce business is no easy task. It takes a lot of hard work, dedication, and time to make it successful. This includes staying vigilant about your customers and their activities. Keep an eye out for suspicious behavior or transactions, and take note of any patterns that may indicate fraudulent activity. In addition to being vigilant, you should also use advanced security measures to protect your business from online threats such as fraud. This includes using strong passwords, anti-virus software, and firewalls.

If you’re in the middle of a fraud experience, you’ll want to hire a lawyer to help you navigate the issue. A law office in Naples, FL, can provide legal services for your businesses. This can be anything from contract review and negotiation to criminal defense representation, but more importantly, they can help you manage a fraud situation.

Running an e-commerce business comes with a unique set of risks and vulnerabilities. One of the most important ways to combat fraud is to identify it early and take steps to prevent it from happening in the first place. By being aware of the most common types of fraud, businesses can take the necessary precautions to protect their customers and their bottom line.